Navigating Your Property Tax Bill in Mecklenburg County: Let's Get You Informed!

Neighbors and fellow homeowners in Mecklenburg County here are the latest updates that matter most to you. Today, let's talk about the new property tax bill that's hitting mailboxes this week, and how we can make sense of it all together.

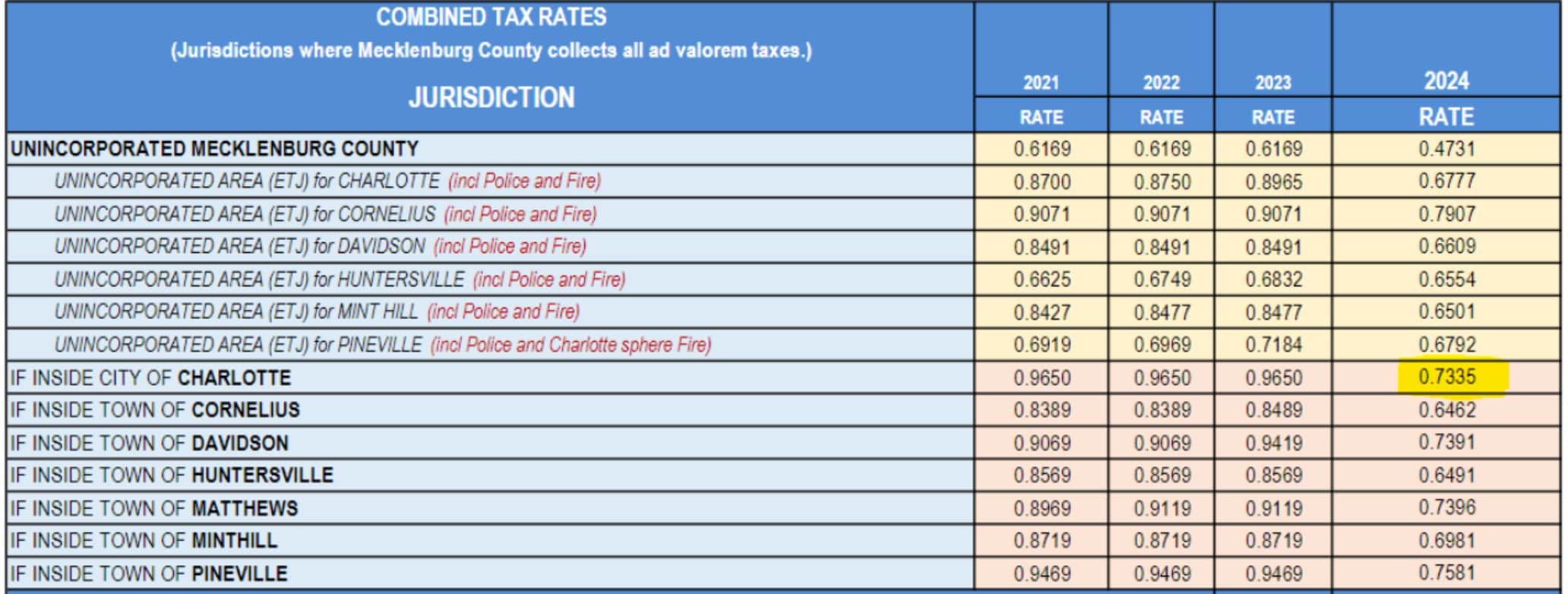

So, what's the deal with Mecklenburg County's property taxes? Well, they're mandated to update the assessed values of all properties every four years, and guess what? They just released the new tax rates for the 2023—2024 period! Exciting stuff, right?

Now, I want to help you understand this process better. To find out your property's new tax rate for this year, you'll need to check your tax bill using the link provided below. It's like unwrapping a present to discover what's in store for you!

Link to New Tax Rates

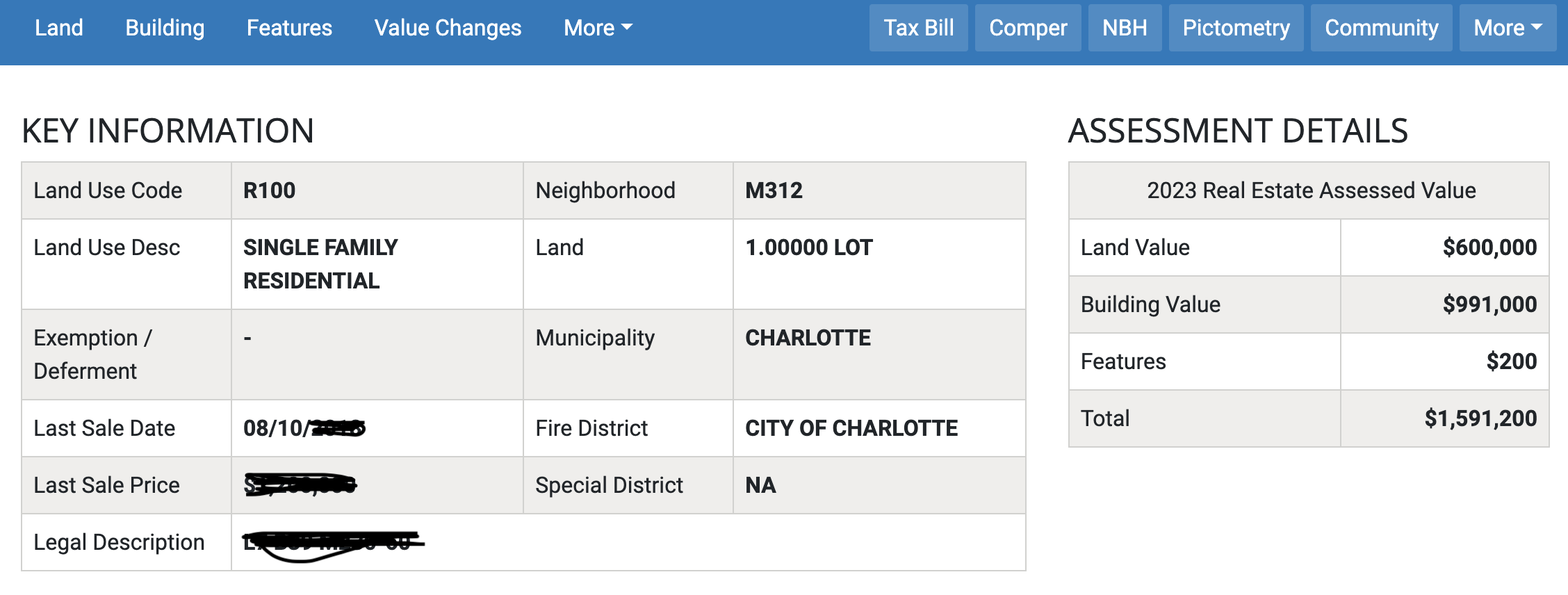

Now, let's get down to the nitty-gritty of calculating your property taxes. Don't worry; it's not as intimidating as it sounds. First, take your property's assessed value and multiply it by the new tax rate for your municipality. Once you have the annual amount, divide it by 12 to find out how much you should budget for your monthly Property Contingency Fund (PCL).

Here's a little example to help you out.

Imagine your cozy home is in the heart of Charlotte, and its assessed value is $1,093,500. With the new tax rate at 0.7335, we can calculate your property taxes like this:

Annual taxes = $1,591,200 x 0.7335 = $9726.21

Monthly taxes = $9726.21 / 12 = $810.51

Ta-da! Now you know how much to budget for your monthly property taxes. But wait, there's more!

When it comes to property taxes, you shouldn't be looking at the prior year's bill anymore. Nope, that's old news. The new assessed values and tax rates are in effect, and that's what we need to work with.

Now, let's address the elephant in the room – higher tax bills. :( Yep, some of you might have already noticed that your tax bill is a bit heavier this time around. Well, you're not alone! County officials have said that about 91% of residential owners should expect higher taxes this year. Why? Because commercial properties increased in value at a slower rate since the last revaluation in 2019.

But hey, there's a silver lining. This year, the Charlotte City Council voted to approve a "revenue-neutral" tax rate. Meanwhile, Mecklenburg commissioners decided to raise the tax rate above revenue neutral by 1.6 cents per $100 of assessed value ($16 per $100,000).

If you have any questions, concerns, or specific situations you want to discuss, reach out to us.